I am a huge proponent of UBI (universal basic income). I strongly believe that everyone has the right to basic services: housing, medical care, education. Numerous studies have shown the value of universal basic income. But some people find it unpalatable. The idea of giving people something for just existing flies in the face of the protestant work ethic. One way around this is negative income tax.

Ontario had a test project once before it was terminated by Doug Ford back in 2018. The idea was to give 4,000 low-income individuals a mere $17,000 a year and see what happened. Participants could work, but for every dollar earned, the UBI amount would be reduced by 50 cents. Early results had shown that participants were using the funds for things like augmenting disability payments, paying back student loans, paying for bus passes and winter clothes.

The project was cancelled because the Ford Government claimed that it acted as a disincentive to work. This is a common argument against UBI. Of course it’s also the same argument used against wick and food stamps. The whole, “pull yourself up by your bootstraps” argument. Which is ironic since “pull yourself up by your bootstraps” actually means to do the impossible.

The average yearly income in Canada in 2024 is $67,282 and the median income, that means half the people make below this amount and half make above, is $41,700. What this means is a few people are making a lot of money to pull the average up from that $41,700. To make things more equitable I think we should introduce negative income tax. Right now the tax brackets look like this:

| Tax rate | Taxable income threshold |

|---|---|

| 15% | on the portion of taxable income that is $57,375 or less, plus |

| 20.5% | on the portion of taxable income over $57,375 up to $114,750, plus |

| 26% | on the portion of taxable income over $114,750 up to $177,882, plus |

| 29% | on the portion of taxable income over $177,882 up to $253,414, plus |

| 33% | on the portion of taxable income over $253,414 |

| https://www.canada.ca/en/revenue-agency/services/tax/individuals/frequently-asked-questions-individuals/canadian-income-tax-rates-individuals-current-previous-years.html | |

And Canadians are allowed $15,705 in tax credits called “basic personal amount.” This essentially lowers your taxable income. And this BPA drops after you make more than $173,205. So if you made less than $15,705 dollars you paid nothing in income tax. But they are non-refundable. Meaning if you made only $12,000 you wouldn’t receive the $3,705 difference as a refund. I think you should.

One objection that leaps to mind is “what about students?” A student living at home might make $10,000 a year working part-time and after school. Should they get the negative income tax? Yes! They would get a $5,705 refund. When you are starting out is when you need the most help. At the start of your career is when you won’t make much money. Entry level jobs don’t pay six-figures. Scott Galloway has this great presentation where he explains why it is so much harder for young people.

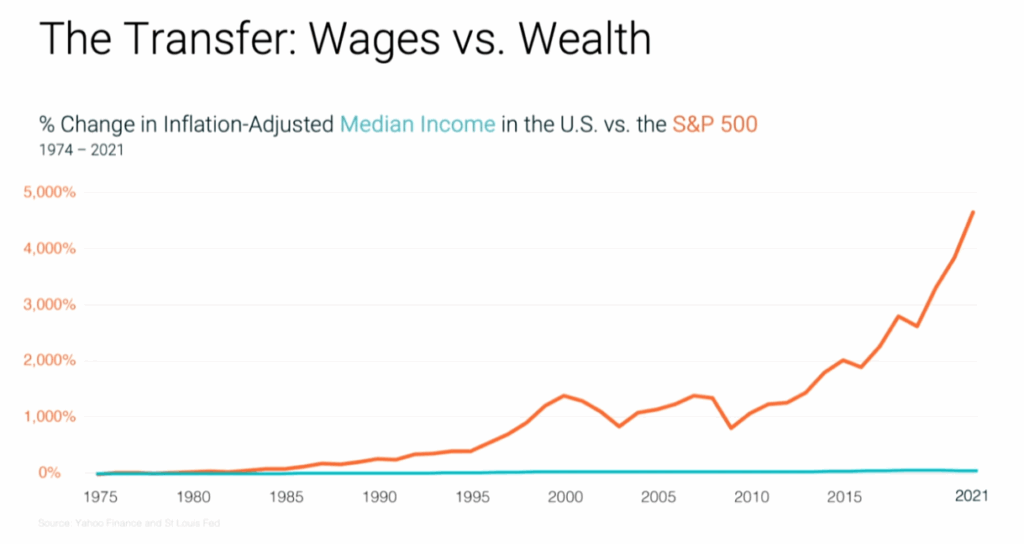

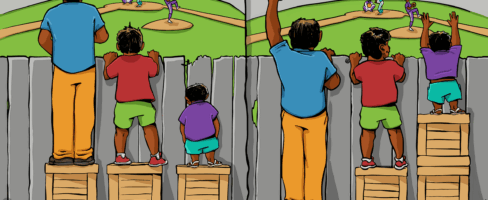

We have this grievous imbalance in wealth and opportunity. Keep in mind that the chart below is percentages, not absolute values. We need to adjust who receives help and who does not.

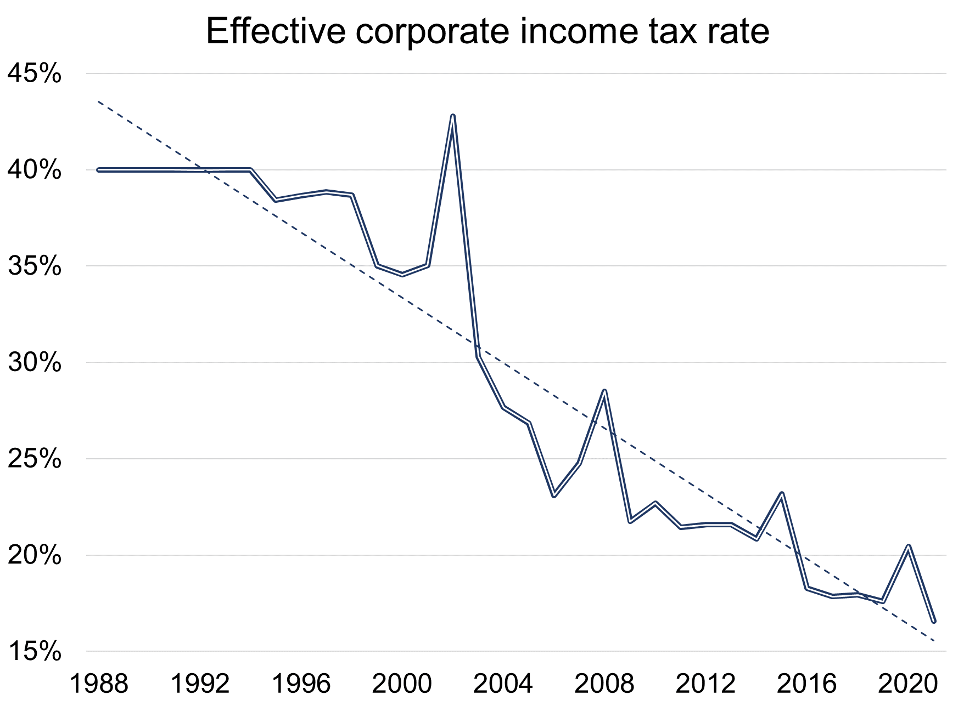

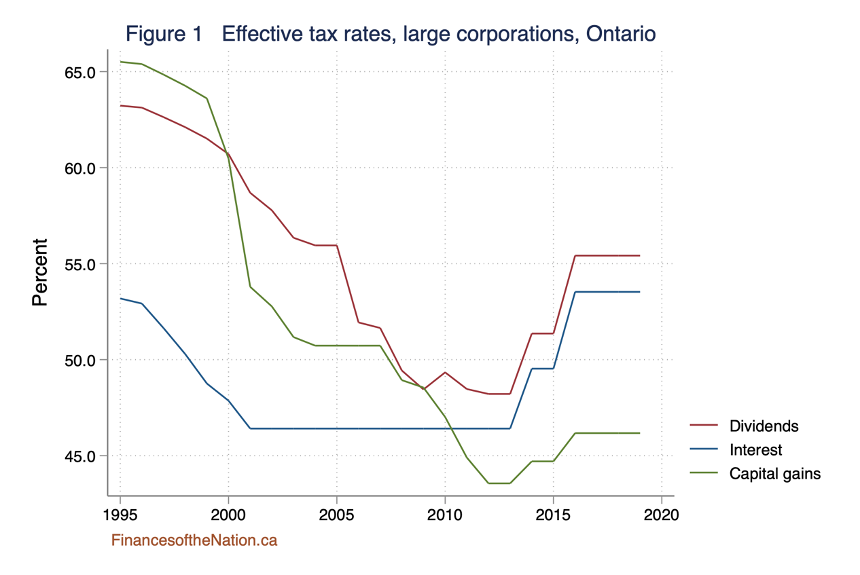

The next question you ask is how should we pay for this? The answer is simple: wealth taxes and corporate taxes. Corporate profits are rising, which we could celebrate if the money wasn’t going to just the shareholders. The notion of shareholder primacy which has it’s roots in a lawsuit about a hundred years ago. Since then we have continued to allow corporations to pay less and less to the public coffers and more and more to shareholders.

A negative income tax would provide help to those who actually need it. Everyone is eligible for it. Making it equal, but only those who need it, get it, making it equitable.

Pingback: MAID in Canada: The Struggle for More Personal Choice - Dave Hamel's Website