As mentioned in the previous post, investing early is the best way to take advantage of compound interest and grow your savings. However, there are a few other things you should keep in mind. Inflation has a real impact on wealth generation both positively and negatively. It’s why the purchasing power of your investments can go down, while price of real assets go up. It is also part of the reason why you should have a diverse portfolio and why you need to actually plan for retirement and not just let it happen.

Inflation – The Silent Wealth Killer

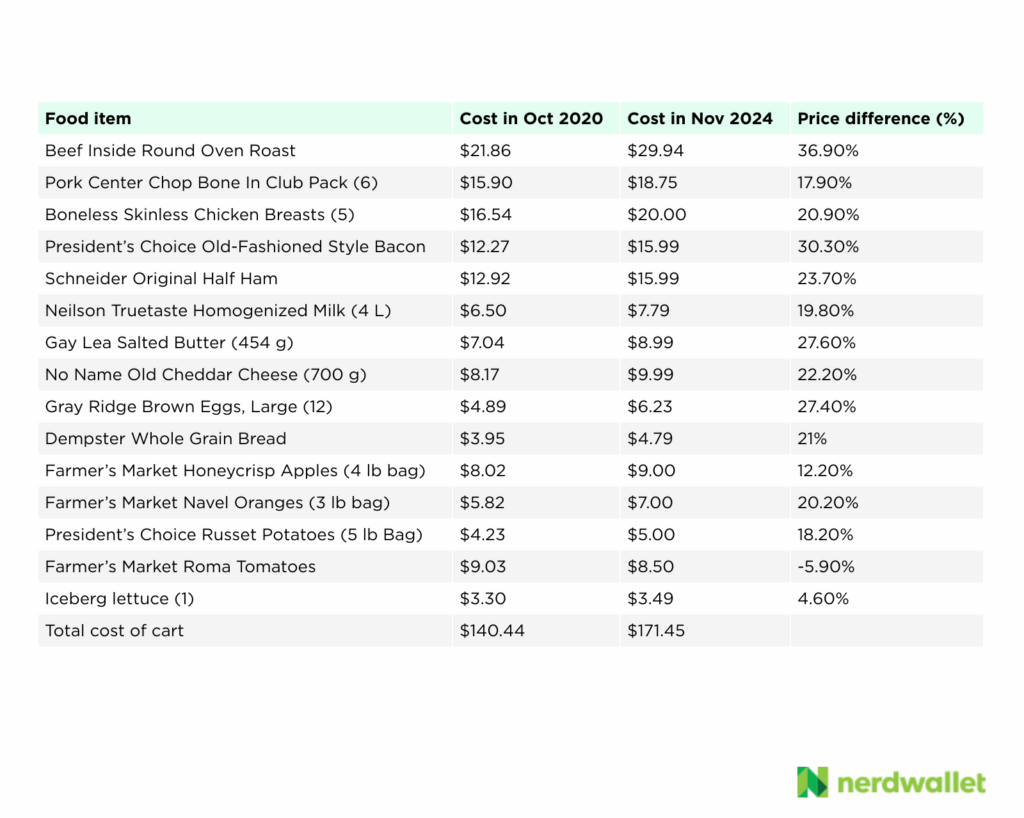

Inflation is why your grandparents could buy a house for $20,000 and now that same house costs $500,000. It’s also why keeping all your money in a savings account earning 1% interest is actually losing you money when inflation is running at 3%. Your actual purchasing power is decreasing. Nerdwallet.com has a post showing the increase in groceries. You investments would need to have a 22.08% increase over the same period of time just to keep the same purchasing power.

The government lies about inflation. Official numbers often understate how much prices are actually rising. Look at your own expenses – housing, food, gas, insurance. They’re all going up way faster than the official inflation rate. This is because the government’s rate takes a number of things into consideration that don’t really affect ordinary people.

And this is why investing matters. If inflation is 3% and your savings account pays 1%, you’re losing 2% of purchasing power every year. It doesn’t sound like much, but over 20 years, that’s a massive loss.

Real estate and stocks are traditional inflation hedges. Real estate because property values and rents tend to rise with inflation. Stocks because companies can raise their prices to keep up with inflation, so their profits and stock prices should rise too. Should being the key word – nothing is guaranteed. Here in Toronto housing prices are falling but inflation is increasing.

Investment Diversification – Don’t Put All Your Eggs in One Basket

When I was working at the gold mine, some guys had their entire retirement savings in mining stocks. Investing in things you understand make sense. But when commodity prices crashed, they lost everything. Gold fell to less than $400/oz so it wasn’t worth mining. It cost more in wages and equipment to extract it than it was worth. Gold is $3,340 an ounce at the time of writing this. If gold at that time had been today’s prices, they’d be rich. But this illustrated why diversification is so important.

Diversification isn’t just about owning different stocks. It’s about owning different types of investments – stocks, bonds, real estate, maybe some international stuff. When one thing is doing poorly, hopefully something else is doing well.

Geographic diversification matters too. Don’t just buy Canadian stocks if you’re Canadian, or American stocks if you’re American. The whole world is connected now, but different markets can move independently. Investing in many regions ensures some part of your portfolio stays above water. A conflict in one part of the world may cause the markets there to deflate, while somewhere else it may be going up.

Once you have diversified rebalancing becomes important. If you want 60% stocks and 40% bonds, but stocks do really well and you’re at 70% stocks and 30% bonds, sell some stocks and buy some bonds to get back to your target. It forces you to sell high and buy low. It also helps keep your portfolio within your risk threshold.

Don’t try to time the market. I’ve seen smart people lose fortunes trying to predict market moves. I have bought when I thought the market was low, but it just kept going down. And I’ve sold at what I thought was the peak and it just kept going up. Dollar-cost averaging – investing the same amount every month regardless of market conditions – usually works better than trying to be clever.

Retirement Planning – More Than Just the 10% Rule

The 10% rule is a starting point, not a destination. If you want to retire at 65 with the same lifestyle you have while working, you probably need to save 15-20% of your income, especially if you start late.

An investment in knowledge pays the best interest ~ Benjamin Franklin

In Canada, understand the difference between RRSPs and TFSAs. RRSP contributions reduce your taxable income now, but you pay tax when you withdraw in retirement. TFSAs are funded with after-tax dollars, but withdrawals are tax-free. If you’re in a low tax bracket now but expect to be in a higher one in retirement, TFSA might be better.

The rule of thumb is you need about 70% of your pre-retirement income to maintain your lifestyle in retirement. But that assumes your mortgage is paid off and you’re not supporting kids anymore. Run your own numbers based on your actual expected expenses.

Don’t forget about government benefits. In Canada, that’s CPP and OAS. In the US, it’s Social Security. These programs might not exist in their current form when you retire, but they’ll probably exist in some form. Factor them into your planning, but don’t count on them entirely.

Consider working longer or part-time in retirement. I know, nobody wants to hear this. But an extra few years of earning and contributing to retirement accounts makes a huge difference. Plus, many people find complete retirement boring.

This advice is free, and worth every penny. Talk to an investment advisor and do your due diligence. The more you plan for retirement the more likely you will be able to live in the manner you’ve grown accustom to.