Assuming you have made a budget, paid off your most egregious debt as suggested in the previous post, you can begin to save for future you. Now before you read any further I should be clear, I am not a financial advisor so take what I have written with a grain of salt and do your own due diligence. There are many different types of investment accounts out there and different brokerages and platforms. I don’t want to recommend a particular platform or investment brokerage. I think that would be overcomplicating things. What I am suggesting below is just a high level overview of how I think about investing, compound interest and how to get started.

I have always used the 10% rule of thumb. Take 10% of every dollar you make and put it away in an investment account. This means if grandma gives you $100 for your birthday, $10 gets saved and invested. If you can start this when you are younger you are so much better off. One – you get in the habit of putting some aside. And two – compound interest will serve you well. You do not need thousands of dollars to start investing. Some funds start with as little as a couple hundred. You can keep the money in a high interest savings account until you are ready.

It’s hard to do this when you are starting your career. Maybe you are living on your own for the first time. When you get that first pay cheque and there are all those things you need to pay for: rent, food, utilities… All those things you promised yourself you would buy when you started working. The shoes, the iPhone, the new bike. I get it. Couple that with the fact that the pay isn’t as good at entry level positions and the problem seems to compound… But it is essential that you start when you’re young. This is because time is on your side. This is the magic of compound interest.

Compound Interest is the eight wonder of the world. He who understands it, earns it… He who doesn’t… pays it. ~ Albert Einstein

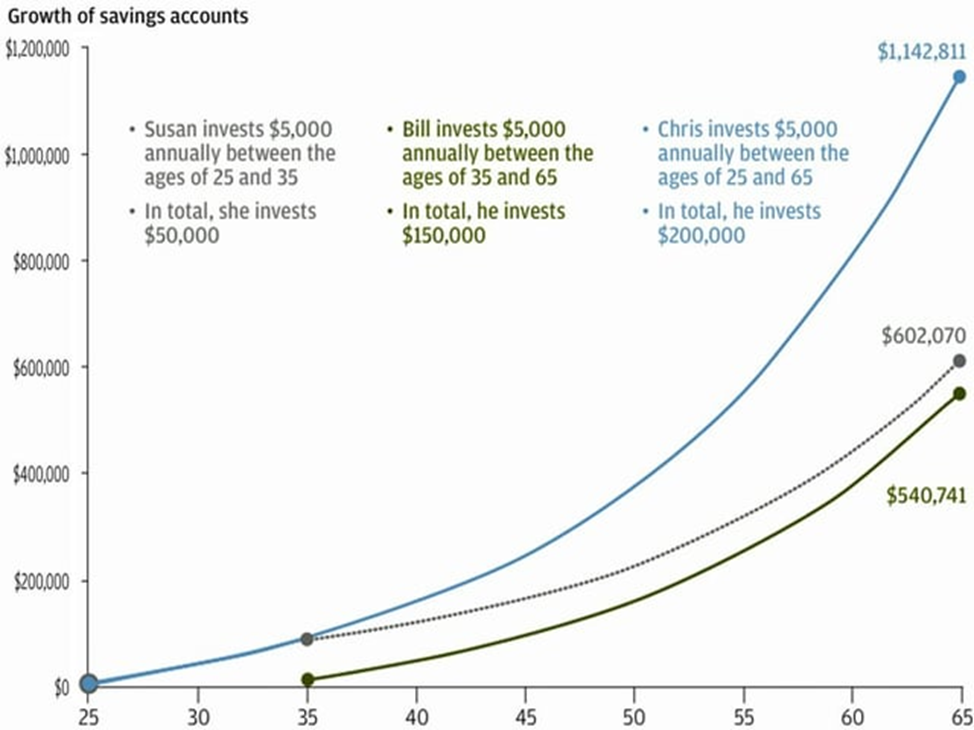

Albert Einstein said of it, “Compound Interest is the eight wonder of the world. He who understands it, earns it… He who doesn’t… pays it.” This is because a small contribution paid early, keeps contributing over time. Look at the graph below from Business Insider.

Susan, who only invests for 10 years out performs Bill. Despite the fact that Bill invested 3 times as much money and started only 10 years after her! And look at Chris, who kept saving and after 40 years outperforms the other two put together. The catch is, you can’t touch the money. You need to leave it somewhere the interest can compound, so the mattress won’t do the trick. Also you need to take care of all that high interest debt first. There is no point in saving $1,000 at 7% interest if you owe $1,000 on your credit card at 19% interest!

And of course every ones life is different and everyone’s risk tolerance is different. Some people are okay with volatility and some are not. There are also many different things you can invest in, all with different features. An RRSP, TFSA, ETF, index funds, LIRA, robo-advisors, 401(k)s. Speak to an investment advisor or financial advisor. You can ask at your bank, and they can help you get started.

Many employers offer employee share programs or RRSP programs. Take advantage of these. It’s free money. You can also count this towards your 10%. For example, a company may match up to 3% of your total salary. If you put away 3%, they give you the other 3%. It’s like getting a raise without doing anything. If you put away 7% and they match 3% there is your 10% saving taken care of. Another advantage of these programs is that they are automatic. You don’t need to do anything. The money is automatically deducted from your pay cheque, so out of sight is out of mind.

Speaking of raises, anytime you get a raise or a bonus, or your income grows it is a good time to review how much money you are putting away. A $6,000 raise might seem like a lot but if it bumps you up a tax bracket, it won’t make any difference so you might as well put it away in an RRSP.

Any major life changes should also trigger a review. For example, you might move to a bigger place with more expenses or a more expensive city, so your emergency fund needs to get bigger. You might get married allowing you to take advantage of spousal RRSPs. You might have kids and maybe an RESP is the right thing to invest in.

If you are wondering what to invest in, or how to invest, I would recommend starting with Dave Chilton’s “Wealthy Barber”. He’s basically recommending mutual funds as opposed to specific stocks. This is because mutual funds are a selection of stocks. Usually based on a theme that is managed for you. For example, you may have a “China Growth Fund” which invests in Chinese start ups. A high-risk fund with the potential for a big payout, or “US Blue Chip Fund” which invests money in blue chip stocks like Coca-Cola and IBM. Lower risk, but lower returns. Also, chances are your bank offers no-load funds meaning it doesn’t cost you anything to invest in their mutual funds.

How ever you decide to approach investing it is crucial that you start as early as possible to take advantage of compound interest and build yourself a nest egg for later in life.